Energy production is intricately linked to water resources, making water stewardship a critical issue for business. Increasing recognition of the strategic importance of water combined with a growing focus on water resilience, climate change impacts, and stakeholder concerns have brought water strategy to the forefront for many businesses.

Additionally, business interruption risks due to water scarcity and disposal constraints are becoming more real. This trend is evident across conventional energy, renewable energy, and low-carbon projects. For instance, while low-carbon technologies provide resilient solutions to energy challenges, several of these technologies—such as hydrogen, biofuels, carbon capture, and nuclear—demand substantial water inputs, exacerbating the strain on already limited resources.

The combination of restricted water availability and aging or insufficient local water infrastructure poses significant challenges for communities and any energy projects proposed for development in those areas.

For example:

- In Corpus Christi, Texas, a project seeking to convert hydrogen into ammonia purchased the last available water rights to a local river, stirring opposition from local officials and environmentalists.

- In May 2024, a proposed carbon capture project in Queensland, Australia, sought to pump carbon into an aquifer and was halted by concerns about groundwater contamination.

- Research from Rystad Energy identified that nine of the 22 projects on the U.S. Department of Energy shortlist for hydrogen hubs are in highly water-stressed areas and are likely to face water availability concerns if they move forward.

- As energy companies supply the growing power needs of artificial intelligence (AI), and the corresponding growth in computing and data centers, there are growing concerns over water usage and environmental sustainability.

How are energy companies responding?

Integrating water stewardship into strategy

Energy companies are increasingly taking steps to integrate water stewardship into their strategies. TotalEnergies, for instance, aims to cut freshwater withdrawals in areas of water stress by 20 percent by 2030 and has conducted assessments at priority sites in water-stressed areas to strategically decrease its water use. Additionally, companies are conducting strategic site-specific water assessments to identify operational efficiencies. In 2023, BP conducted site-specific assessments covering 51 percent of its total water consumption by assessing just four refineries. Pioneer Natural Resources aspires to source 90 percent of the water used in fracturing operations from recycled sources by 2030.

Many energy companies are adopting Ipieca’s water stewardship guidance which is structured around the Alliance for Water Stewardship’s desired outcomes:

- Sustainable water balance

- Good water quality status

- Good water governance

- Important water-related areas

- Safe water, sanitation and hygiene for all

Ipieca’s guidance also incorporates the water mitigation hierarchy: avoid, replace, reduce, reuse/recycle, and replenish – a solid platform of approach and action that companies can adopt. Recognizing water’s crucial role in their operations, Ecopetrol, Eni, Repsol, TotalEnergies, and others have also joined the CEO Water Mandate, a UN Global Compact initiative promoting water solutions aligned with the Sustainable Development Goals.

Transforming wastewater into an asset

Energy production requires water, and it also creates water as a byproduct. An oil field typically generates about three barrels of produced water (PW) for every one barrel of oil over its lifespan. In some geographies, this ratio is significantly higher. Energy companies have been accelerating their efforts to improve the treatment of wastewater and increase its reuse.

Produced water usually has high salinity and may contain radioactive materials and therefore requires special treatment and handling. In the U.S., slightly over half of PW is disposed of, typically by reinjecting it back into the ground, and only some of the water is reused.

Incentives for reusing produced water are growing. On March 12, 2025, the U.S. Environmental Protection Agency announced plans to review regulations to expand wastewater reuse, including for lithium and mineral extraction. States like California, Colorado, New Mexico, Oklahoma, Pennsylvania, Texas, and Wyoming are considering or implementing regulations for PW use beyond oil and gas. In January 2025, the Texas Railroad Commission (RRC) proposed an update to its PW rules. The proposed rule would strengthen standards around produced water recycling facilities but would allow operators to recycle PW without needing a permit by drilling, fracking, and making wells ready for completion.

Additionally, in March 2025 the Colorado Energy and Carbon Management Commission adopted rules, effective January 2026, mandating that 4 percent of water used in new oil and gas developments comes from recycled PW. This would increase to 35 percent by January 2038.

Technological and market developments are increasingly enabling companies to transport and purify produced water and extract valuable minerals from it, transforming wastewater into a valuable resource. For example, ExxonMobil, Occidental, and Chevron are making investments to extract lithium from produced water, and a burgeoning water transport industry (including midstream water transport companies), brings produced water from well sites to treatment facilities or disposal wells.

Purified produced water could create additional opportunities. For example, Eni’s 'Blue Water' technology reuses produced water for industrial purposes. Saudi Aramco has explored using produced water to grow crops and to produce biofuels. (the World Bank’s report Water Management in Oil and Gas Operations: Industry Practice and Policy Guidelines for Developing Countries provides more case studies).

Minimizing water impacts from water-intensive projects through site selection and technology solutions

Water plays a critical role in guiding companies in the site selection process for energy projects, whether conventional, renewable, or low carbon. ERM’s water specialists have identified that local water availability, frequently exacerbated by insufficient local water infrastructure, influences the go/no-go decision for approximately 75 percent of new energy projects.

| Aging and inadequate infrastructure further challenges water stress and site development. In 2024 in the U.S. alone, there was a $91 billion gap between water infrastructure needs and spending. |

For example, to enable AI growth, many energy companies are planning to co-locate low-carbon power generation facilities with computing and data center partners. These initiatives are substantial in scale and present significant siting challenges, particularly in identifying locations with adequate water resources to satisfy the cooling requirements of power production, data centers, and local communities.

To address water stress, energy companies are increasingly opting for locations that can support sustainable production over the long term. They commence with high-level screenings of water availability to identify potential sites, which are subsequently ranked based on water supply options, resulting in a shortlist of the most viable locations.

Other energy companies are investing in technologies and partnerships that can reduce impact on local water supplies. For instance, in December 2024, Sinopec successfully completed a desalination pilot project to produce green hydrogen using specialized equipment and processes able to handle corrosive, salty ocean water. In September 2024, Apex Clean Energy entered an agreement with a city in Kansas to purchase water from a wastewater treatment plant to be turned into green hydrogen.

The road ahead: What companies can do now

Energy companies are integrating water risk management into their broader sustainability strategies and embracing the opportunity to progress these strategies over time. Leading companies have found that to truly address water-related risks, water considerations need to be embedded into decision-making at every level—from project siting and engineering design to daily operations and long-term planning. Energy companies looking to proactively manage this issue can consider the following steps:

- Conduct top-down and bottom-up water risk assessments: The best practice for identifying water risk is to pair a top-level portfolio water screening with site-specific water risk assessments and then develop a water action plan. Top-down screening tools, such as the Aqueduct Water Risk Atlas, Local Water Tool for Oil & Gas, Water Risk Filter, and Water Risk Monetizer, offer a holistic view of water risks, while local assessments are more tailored and can help identify unique site-specific conditions.

Figure 1: Factors to consider when conducting a water risk assessment

- Design for water resilience and decarbonization. Water should be considered in parallel to plans to reduce CO₂ emissions. Water implications within new low-carbon business lines should be considered at early-stage corporate strategy development along with net zero business transformation plans.

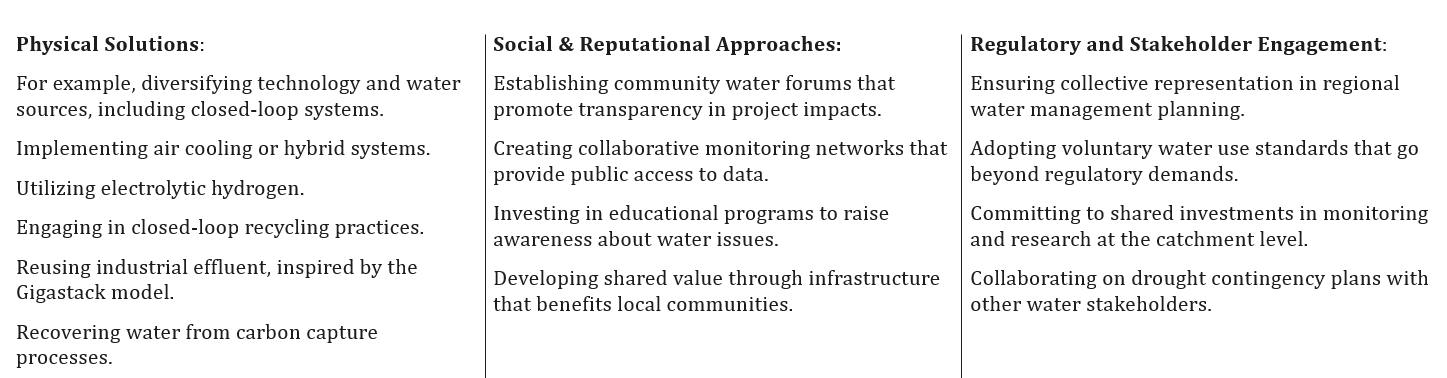

Figure 2: Practical steps to design for water resilience

- Reduce water dependency and increase efficiency: Focusing on their water-intensive sites, energy companies can conduct facility-based water assessments that aim to identify operational efficiencies and in-facility reuse options.

- Join collaborations and adopt business-relevant standards: Energy companies can explore opportunities to collaborate with like-minded peers, including public and private-sector led organizations, university collaborations, and joining groups such as the CEO Water Mandate and its Water Resilience Coalition as well as the Alliance for Water Stewardship. Companies can also join local and regional collective action initiatives to support communities while addressing the shared challenges of increasing water insecurity.

- Seek opportunities to repurpose water: Adopt new technologies to reuse produced water for industrial or other purposes and consider partnering with midstream water companies or others in the industry. This can bring financial benefits while lessening environmental impact.

Conclusion

Energy companies are increasingly recognizing the importance of integrating water risk management into their broader business strategies. Many are undertaking thorough water assessments, improving operational efficiency, and investing in water stewardship initiatives to mitigate business risks. Additionally, technological advancements enable energy companies to reuse and repurpose water, transforming a potential liability into an asset.

A systematic approach is necessary to ensure that the transition to a low carbon economy does not exacerbate water challenges, particularly in water-stressed regions where resource competition is already high.

To maintain resilience, energy companies should incorporate water considerations into decision-making at every level—from business development strategy to project siting and engineering design through daily operations and long-term planning. Conducting comprehensive water risk assessments, collaborating with stakeholders, and leveraging innovative water reuse technologies will ensure a viable future and long-term business resiliency.