Steel is an essential component of the low carbon economy. Despite recent saturation of the steel market, production levels are set to keep rising through 2050 to fuel global economic expansion, urbanization and renewable energy infrastructure.

Due to its dependence on coal and coke as fuels and reducing agents, steel manufacturing remains one of the largest sources of greenhouse gas (GHG) emissions globally, responsible for around 8% of total energy-related CO2 emissions. Additional embedded GHG emissions arise in other parts of the iron and steel value chains, including in mining, transporting raw materials and finished products, and from the energy and electricity used in different manufacturing steps.

As steel companies worldwide prepare for an EU carbon tax on steel from 2026 due to the introduction of the Carbon Border Adjustment Mechanism and the phase-out of free allowances under the EU Emissions Trading Scheme (ETS), many are considering how to lower the GHG emissions of both their production methods and value chains to remain competitive.

Primary v. secondary steel production

Some steelmakers are shifting from producing primary steel, using iron ore, to less energy- and GHG-intensive secondary steel, using steel scrap. However, limits in global scrap availability challenge the growth of this production route, making it imperative for steelmakers to find ways to reduce emissions in primary steel production.

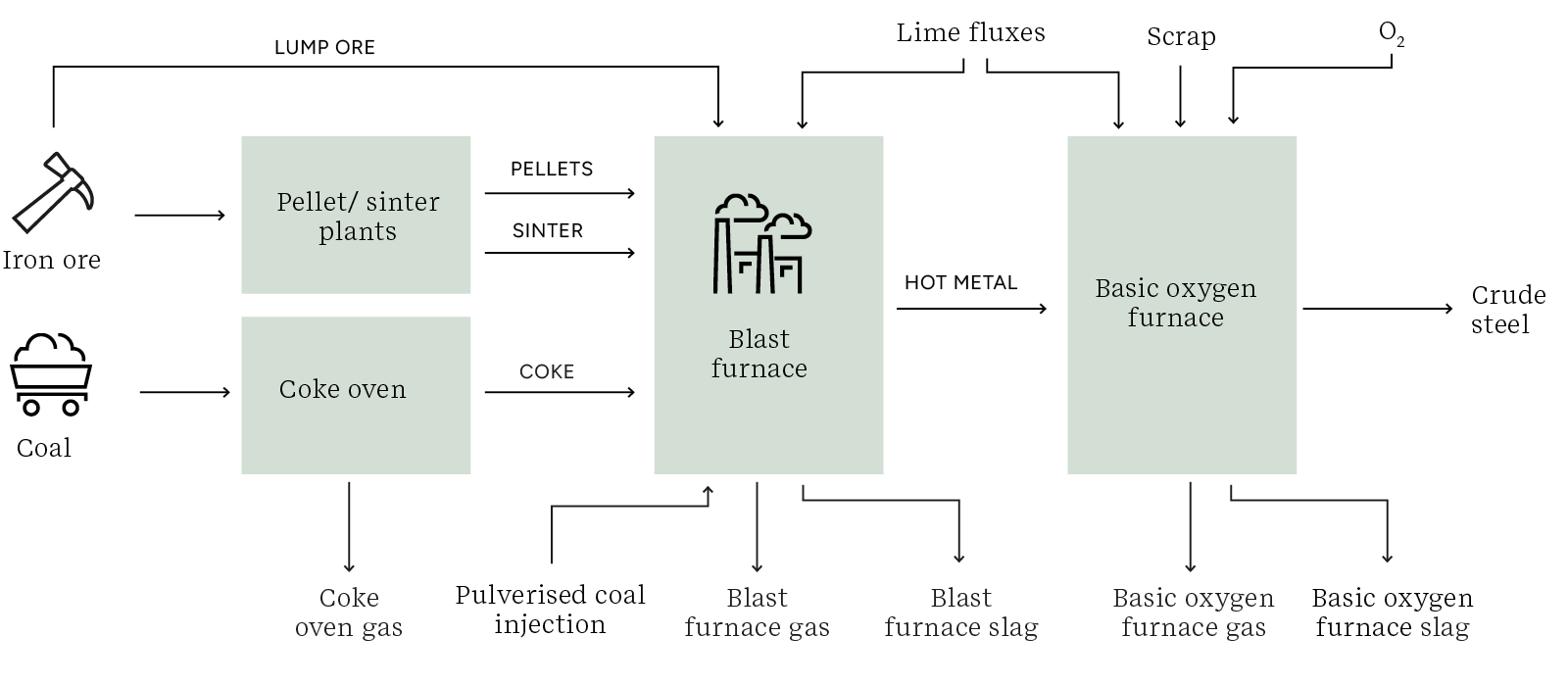

While energy efficiency improvements or a higher proportion of scrap use can reduce some GHG emissions in coal-based primary steel production, known as basic oxygen steelmaking (figure 1), this alone will not lead to the deep emissions reductions needed to meet global climate targets.

|

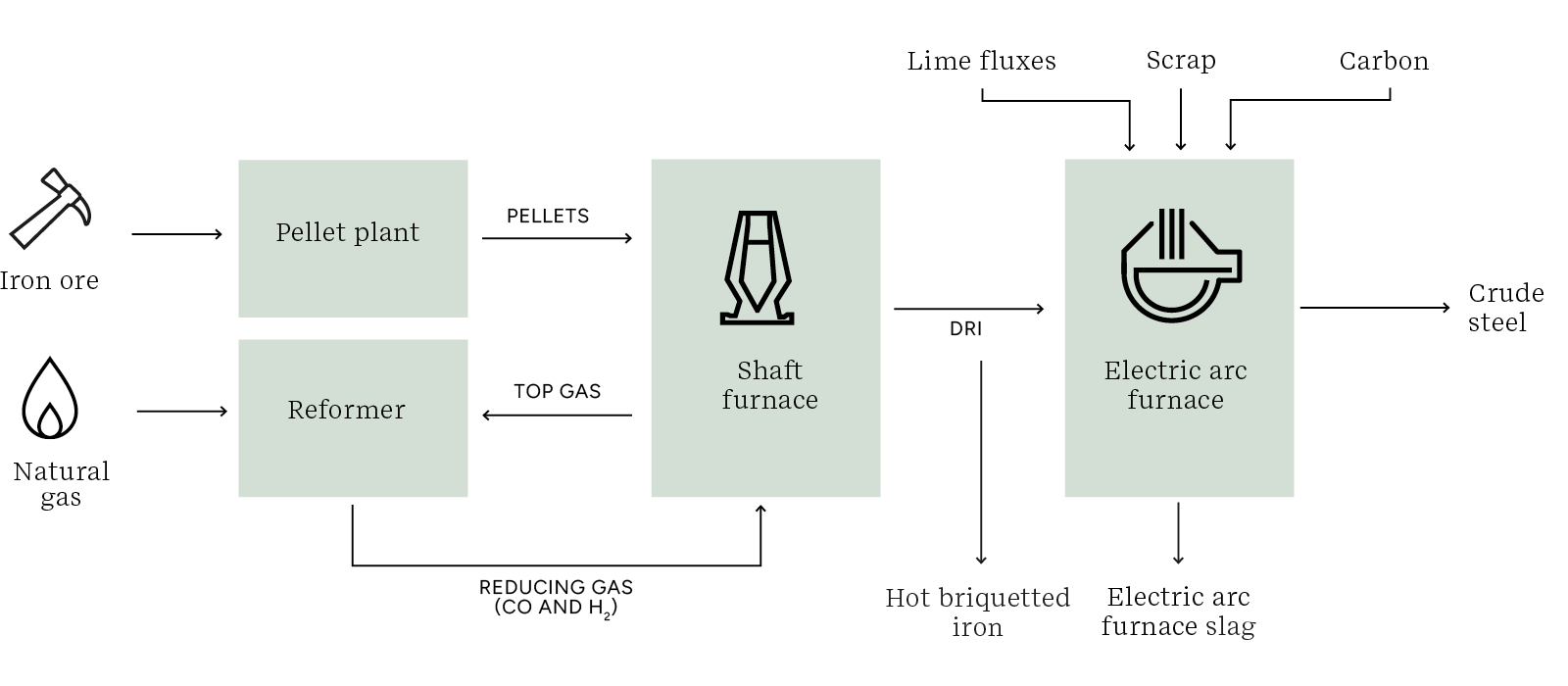

Figure 1: Conventional primary steel production pathways: basic oxygen steelmaking and direct reduced iron-electric arc furnace Basic oxygen steelmaking (BF-BOF) - the combination of producing iron in a blast furnace (BF) and feeding this to a basic oxygen furnace (BOF) is the most common and carbon-intensive steelmaking pathway taking place in integrated steel mills. Basic oxygen steelmaking uses metallurgical coal as its main energy input and represents virtually all current primary steel production in Europe.

|

Balancing cost against carbon

Lower carbon steel production pathways are emerging, for example those using carbon capture and storage (CCS), alternative technologies for iron ore reduction and/or sustainably sourced biomass-based feedstocks.

Hydrogen-based direct reduction (H-DRI) technology is quickly gathering pace in Europe, with multiple announcements of new plants. Other steel producers, particularly outside Europe, are considering retrofitting their integrated steel mills with CCS to enable use of existing equipment.

However, not all new steel making technologies will deliver deep emissions cuts and, while the effective carbon price paid by steel producers remains relatively low, all of these technologies will come at an additional cost.

ERM research for the IEA Greenhouse Gas R&D Programme (IEAGHG) profiling the lifecycle costs and emissions of emerging lower carbon steel technology pathways within the EU (figure 2) reveals:

- Only a few steel production pathways can achieve deep emissions intensity reductions (over 70%), even by 2050. These pathways all involve transitioning away from blast furnaces towards electric arc furnace (EAF) steelmaking technology, such as 100% renewable H-DRI.

- Residual GHG emissions, including direct emissions at the steel mill and emissions embodied in raw materials, are significant even for the best-performing pathways.

- There remains an enduring cost gap between traditional and lower carbon steel production. Comparing the costs of different technology pathways shows basic oxygen steelmaking (BF-BOF) has the lowest levelized cost of production, even after accounting for projected EU carbon pricing (around €80/t CO2 in 2022 to almost €200/t CO2 by 2050) and including the phase out of free EU ETS allowances for steel producers by 2034.

Figure 2: Breakeven carbon price and emissions intensity reduction for different primary steelmaking routes within the EU compared to BF-BOF production (2025-2050)

Source: ERM analysis comparing steel production costs and emissions intensity reduction under different pathways from a lifecycle perspective, from 2025 to 2050. Fossil global warming potential (GWP) was calculated in line with the ISO 14040 series and World Steel’s Life Cycle Inventory. ERM’s study was commissioned by the IEAGHG.

|

The breakeven effective carbon price and the level of emissions intensity reduction is expected to improve over time for all technology pathways. These two trends can be explained by a combination of drivers:

|

How steel producers and stakeholders can accelerate low carbon technologies

The steel sector and its stakeholders are rapidly waking up to the decarbonization challenge, including the need to improve the cost position of lower carbon technology pathways, reduce supply chain emissions and ensure a just low carbon transition.

For steelmakers looking to decarbonize, low-carbon steelmaking does not necessarily need to reach cost parity with BF-BOF steel to be competitive, as increasing numbers of steel buyers are willing to pay a green premium for low-carbon steel and more government support becomes available to fund decarbonization.

Steel producers, the power sector, raw material suppliers, policymakers, steel buyers and financial institutions can all play their part in accelerating steel decarbonization, by taking the following actions:

Although current carbon price projections may not by themselves make low carbon steel technologies more economical, companies that shift to these technologies can avoid losing market share, revenues and access to capital in the future as managing and eliminating GHG emissions becomes a core part of procurement for steel buyers and a key concern for investors.

The ERM project team would like to thank Abdul’Aziz Aliyu and the IEAGHG Expert Panel for their input into this research.