On March 6, 2024, the U.S. Securities and Exchange Commission (SEC) took a significant step by finalizing new climate disclosure rules for companies registered with the agency.

While the final rules include significant changes from the proposed version released in March 2022, the SEC's action reflects growing recognition by investors and businesses that climate change poses financial risks. The new rules aim to provide investors with consistent, comparable, and reliable information about the financial effects of climate-related risks on a registrant’s business, as well as information about how the registrant manages those risks. Company boards, chief executive officers, chief financial officers, chief operating officers, and general counsels are now critical stakeholders, and compliance will require working with corporate sustainability teams to ensure the processes and rigor of financial reporting are applied to climate-related reporting.

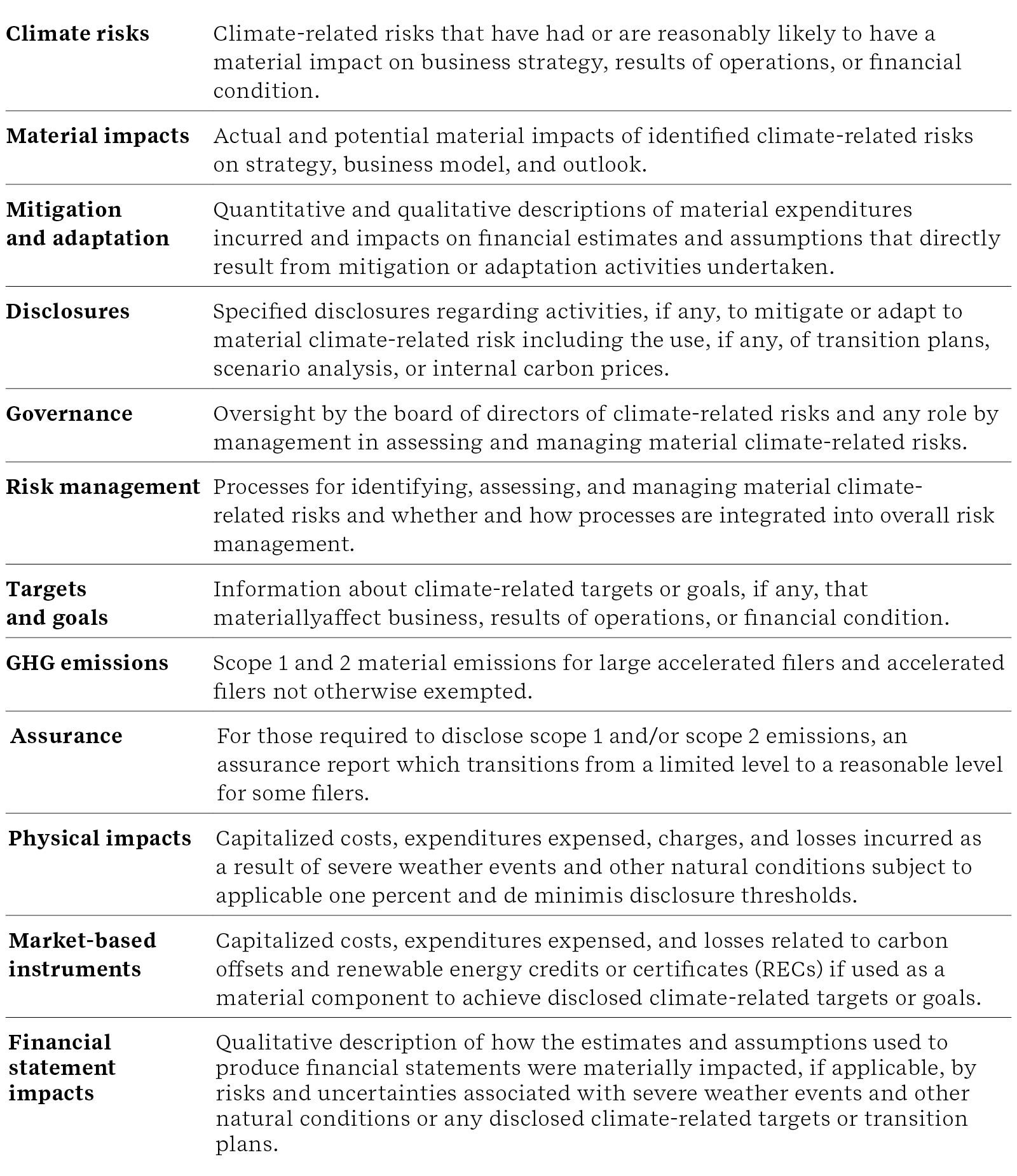

Requirements of the SEC climate rules

The SEC's final climate disclosure rules borrow structure, definitions, and some specific conditions from the Task Force on Climate-related Financial Disclosures (TCFD), while also incorporating elements from the Greenhouse Gas Protocol standards for reporting on greenhouse gas (GHG) emissions. The SEC acknowledges the need for a smooth transition to the new disclosure requirements and has implemented a phased compliance schedule based on company size and complexity of disclosures. While companies will need to evaluate their climate disclosure practices for potential gaps with SEC requirements, the ruling provides companies with a valuable opportunity to differentiate themselves based on carbon performance and gain competitive advantage in the low-carbon economy.

For more information on the finalized rules, please refer to: Final rules: The Enhancement and Standardization of Climate-Related Disclosures for Investors

Disclosure requirements

The SEC has communicated that the latest regulations will require a company (including a foreign private issuer) to:

- File its climate-related disclosures in its registration statements and ExchangeAct annual reports filed with the SEC.

- Provide the Regulation S-K mandated climate-related disclosures either in a separate, appropriately captioned section of its registration statement or annual report, or in another appropriate section of the filing, such as Risk Factors, Description of Business, or Management Discussion and Analysis. This can also be achieved by incorporating such disclosure by reference from another Commission filing as long as the disclosure meets the electronic tagging requirements of the final rules.

- Electronically tag climate-related disclosures in Inline XBRL.

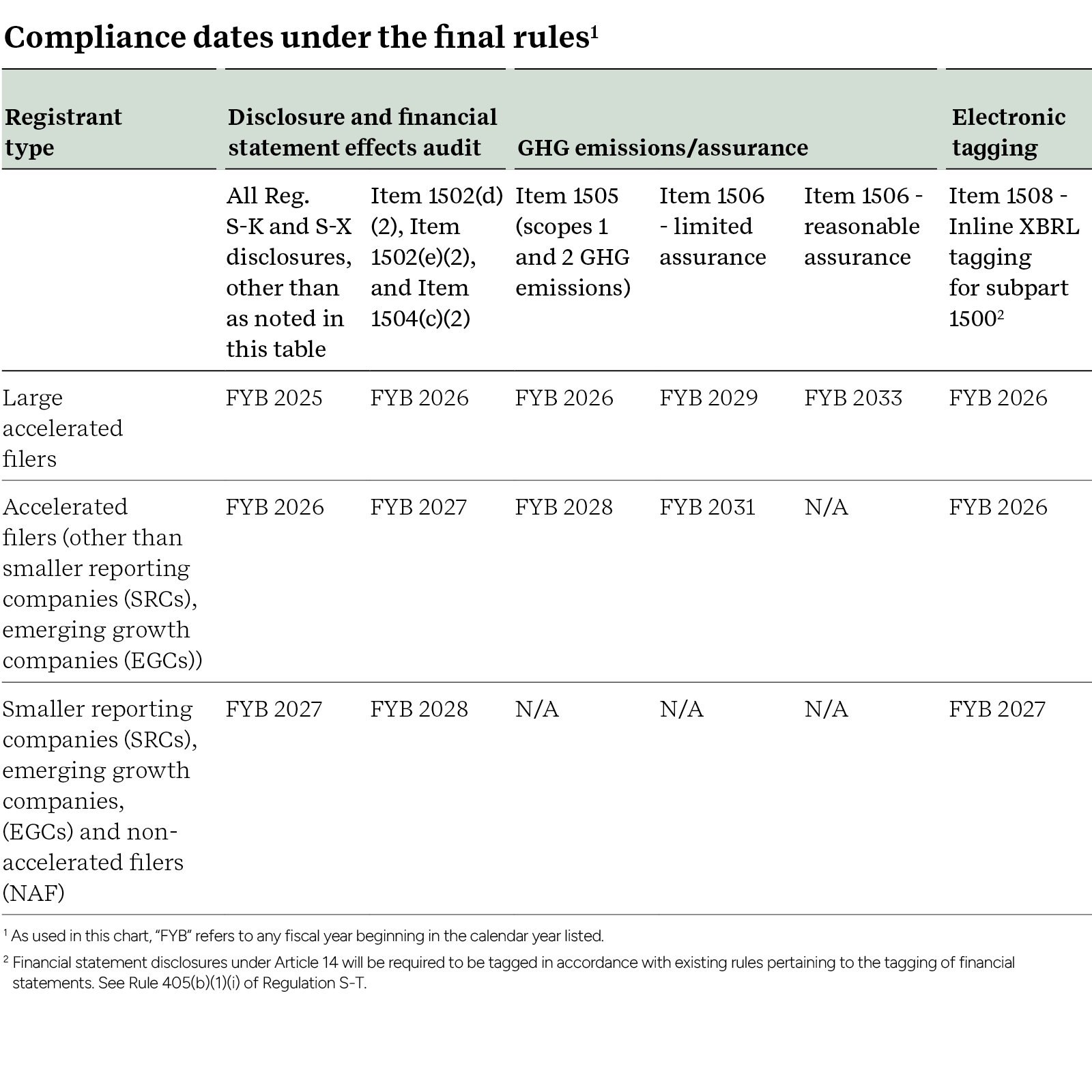

Disclosure timelines

The final rules will become effective 60 days after publication in the Federal Register, and compliance will be phased in as follows.

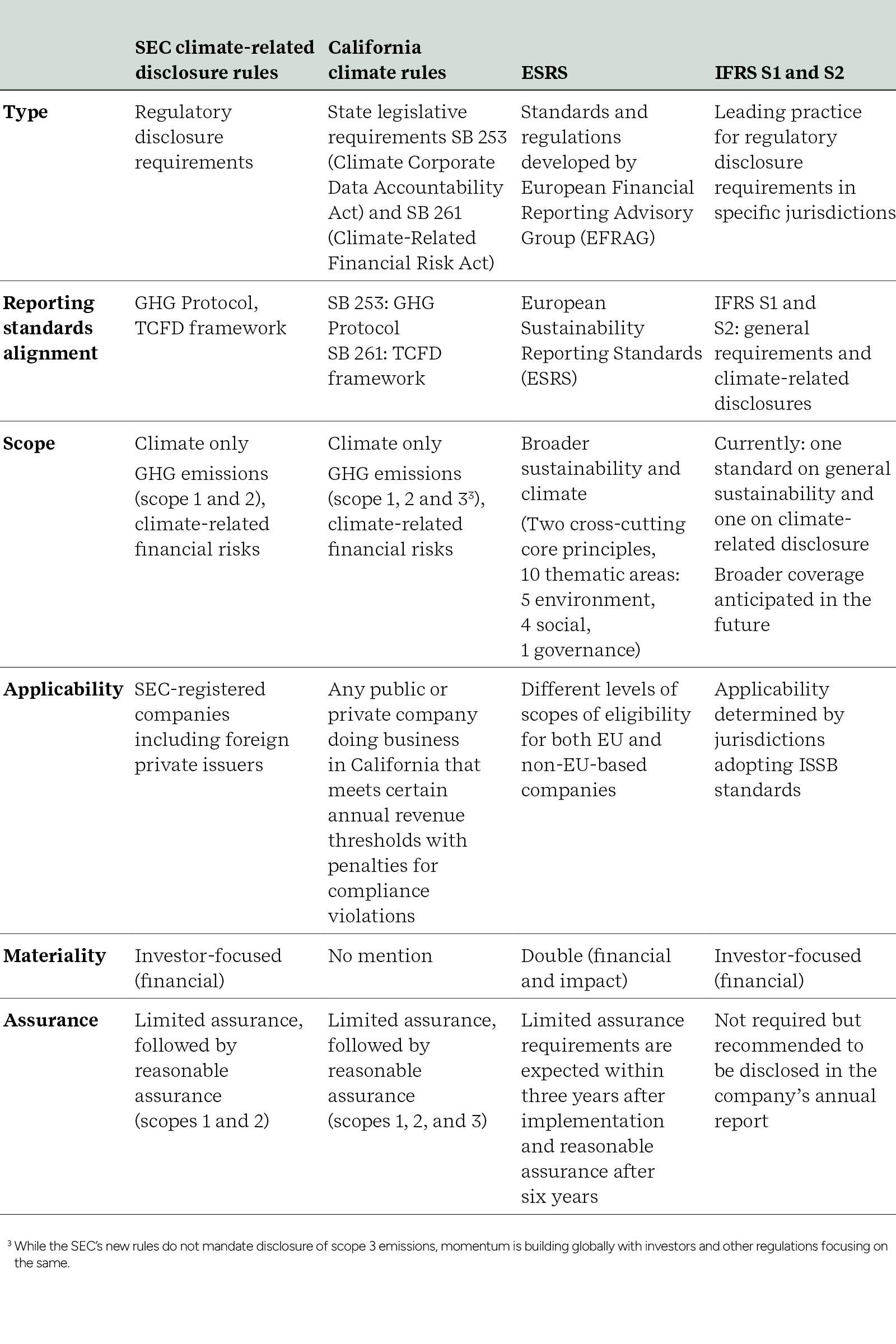

SEC climate rules comparability

SEC climate rules comparability

The below table summarizes how the SEC climate rules compare with the California climate rules, European Sustainability Reporting Standards (ESRS), and International Financial Reporting Standards (IFRS) disclosure requirements.

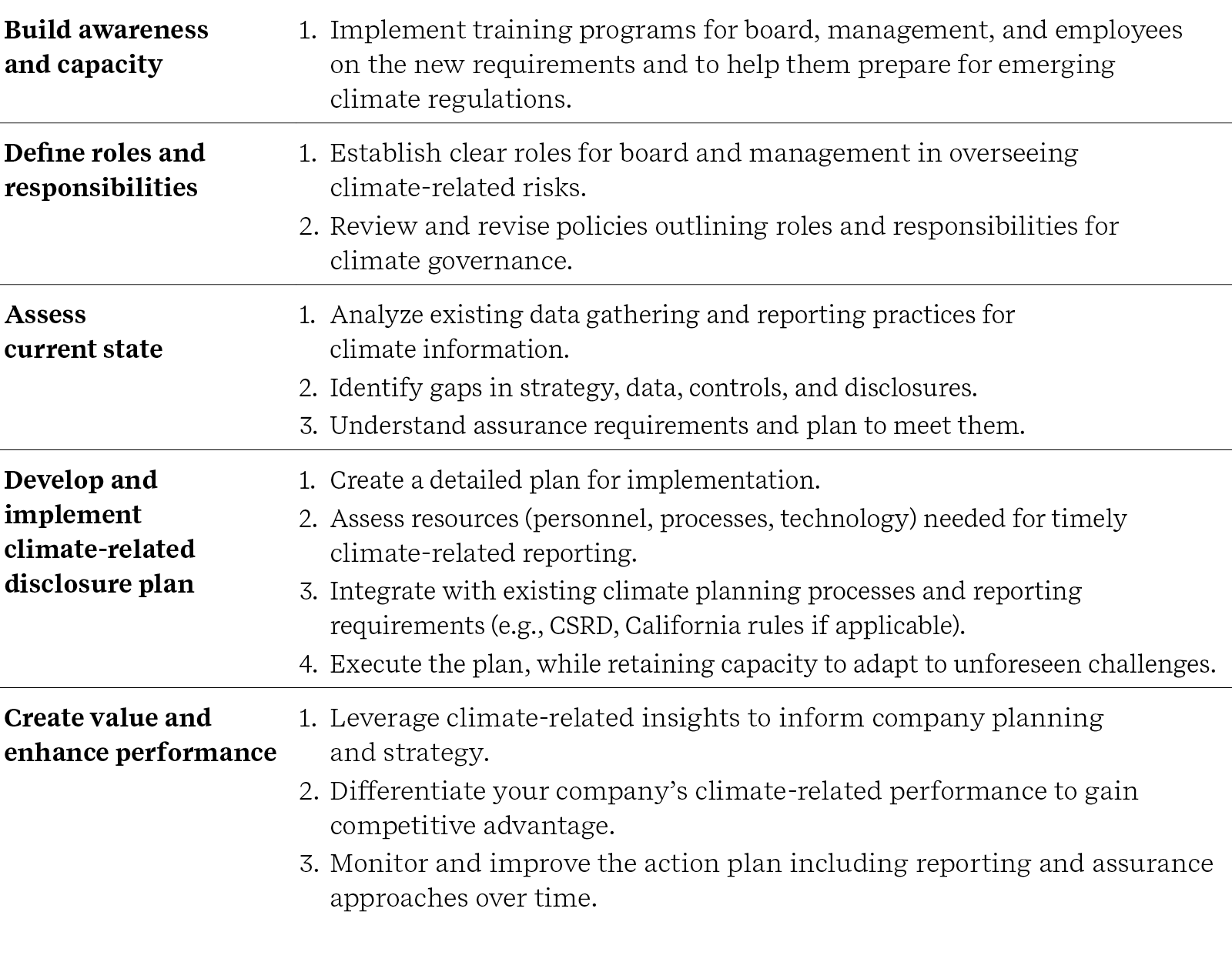

Next steps for companies

Next steps for companies

The SEC's new climate rules significantly expand climate-related disclosure requirements. Companies can leverage the time before the rules come into force to develop the robust reporting capabilities and data management systems compliance will require. Even while the rules go through legal challenges, companies should enhance climate-related disclosure capacity. Here are key steps companies should consider:

By taking these proactive steps, companies can ensure they are prepared to meet the SEC's new climate disclosure requirements and contribute to greater transparency and accountability on climate issues.

By taking these proactive steps, companies can ensure they are prepared to meet the SEC's new climate disclosure requirements and contribute to greater transparency and accountability on climate issues.

ERM’s point of view

New SEC climate disclosure rules are here, requiring public companies to shed light on environmental risks and their financial impacts. At ERM, we understand navigating these complexities can feel overwhelming. ERM has deep experience translating climate risk to financial disclosures. We help you understand how to leverage the climate rules to inform your Board, strategy, targets, and risk management, and create a roadmap for long-term success. By focusing on the most crucial sustainability issues for your business and aligning with investor expectations, we can help you:

- Prioritize resource use: Invest strategically in sustainability initiatives that make a real difference.

- Build resilience: Develop a future-proof strategy that considers both climate risks and opportunities.

- Strengthen your reputation: Showcase your commitment to responsible business practices and compliance to win the trust of stakeholders.

- Attract top talent and investors: Become amagnet for talent and investors who prioritize sustainability leadership.

How ERM can help you

At ERM, sustainability is our business. We are the world’s largest advisory firm focused solely on sustainability. ERM has been a trusted partner to organizations navigating the complexities of sustainability related disclosures for over 51 years. ERM was lauded as the ESG And Sustainability Consulting Leader by Verdantix Green Quadrant (2024), appointed Best ESG Advisory Firm by Private Equity Wire (2024), named Climate Change Consulting Leader by Verdantix Green Quadrant (2023), and recognized as the #1 Sustainability service provider by HFS (2022).

ERM brings unparalleled expertise to support your company’s documentation, governance, process controls, data, and technical capacity of personnel generating climate data. ERM can assess readiness and work with your team to compile disclosures that are investor grade and audit ready. ERM has delivered over 250 TCFD climate-related risk analyses to clients in every industry. ERM partners with companies to advance their decarbonization journeys, from compiling inventories to setting targets, decarbonizing products and assets, disclosing results, and more.

ERM CVS, a global specialty business under the ERM umbrella, has been conducting sustainability assurance for over 25 years. We are a respected, independent third-party provider, delivering assurance to over 200 clients annually (both at the Limited and Reasonable level). ERM CVS conducts assurance in accordance with the globally recognized standard referenced in the SEC regulation (ISAE 3000). ERM CVS is also engaged with the International Auditing and Assurance Standards Board (IAASB) to develop the next set of globally recognized sustainability assurance standards (ISSA 5000), to be launched at the end of 2024.

For more information, or to be connected to our teams, please contact one of the following experts:

Rahul Arora

Partner and Global Lead – Sustainability Strategyand Disclosures TC

rahul.arora@erm.com

Atlanta, GA

Robert LaCount

Partner and North AmericaLead – Climate Change

robert.lacount@erm.com

Washington, DC

Jennifer Klie

Partner and NorthAmerica Lead – CSRD

jennifer.klie@erm.com

Cleveland, OH

Michael Cheatham, P.E.

Associate Partner, Engineer, Global Lead – Energy &Climate Change TC

michael.cheatham@erm.com

New Orleans, LA

Beth Wyke

ERM Certification and Verification Services, Inc.,Partner and Global Head of Corporate Assurance

beth.wyke@ermcvs.com

Philadelphia, PA